Blockchain and Cryptocurrency

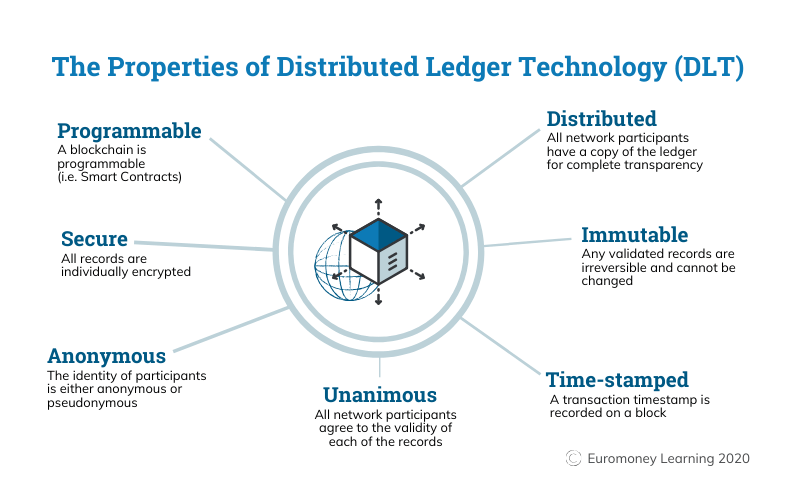

Cryptocurrencies are a digital asset or virtual currency that uses Blockchain technology to operate, secured by a cryptographic layer, making them almost impossible to copy and double-spend (Frankenfield, 2021). A Blockchain is essentially a unique type of database. Unlike a traditional database housed in a central computer, a Blockchain is distributed across a large network of computers, each with its own record. Meaning, no one computer has central control of the blockchain. Each of these computers is referred to as a ‘node’. If a node were to fail, the blockchain would still function as the other nodes would still be able to operate the database (Conway, 2021).

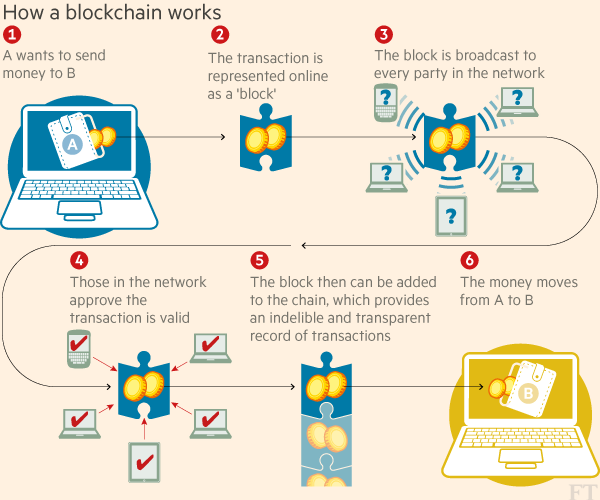

The blockchain stores data about transactions of value between peers on the network; as transactions are created, the data is stored within a block. As each block is completed, ‘a hash code (hash) is created by a math function that takes digital information and generates a string of letters and numbers from it’ (Murray, 2018, para. 6) for its unique identification. Then each block is linked together in a chronological sequence called a chain that contains the current generated hash and the hash from the previous block. By doing this, it has created a tamper-resistant, immutable record of the transaction that is impossible to change. Any change to a completed block changes the hash created for the current and subsequent block, making it easy for malicious activities to be noticed (Murray, 2018). The distributed records need to be compared and validated for the current transaction across the network to be completed. This makes for secure transactions by building in peer-to-peer trust without the need for any third-party mediation (Yaga et al, 2018).

A blockchain can either be private, used within an organisation, or public, used between organisations (IBM, n.d.). As well as the transactions being irreversible, the ledger of transactions is transparent, making it available to all parties involved. In order for a transaction of value to take place, public and private keys are required. These keys are like two halves of a digital signature. The keys are used to access a digital wallet to carry out transactions peer-to-peer. The public key is an address in the form of an alphanumeric code combination that is available for any other party to view and use. The private key is only to be used by the public key owner, like a pin number on a traditional bank account. In this, blockchain is decentralised, immutable, transparent and secure (Conway, 2021).

Although blockchain has been around for quite a while, the uptake and use cases are just starting to take hold in various segments of the economy. The most significant uptake has been in transactions and payments through cryptocurrencies like Bitcoin. A secondary market for cryptocurrencies has developed through smart contracts with the likes of Ethereum, and more recently, Cardano (Shumba, 2021). They have built a platform to program in rules directly to a contract between two parties without the need for a mediating third party, which creates a peer-to-peer trust mechanism in a protocol for the transfer of value at an agreed point. Following this, a new fintech revolution has taken place with a new financial product called decentralised finance (Defi), also built upon the Ethereum ecosystem. This has created a flood of new cryptocurrencies that have use cases such as yield farming and lending services using currently owned tokens as either collateral or staking (Ketchell, 2021). A new digital asset class has emerged and seen a large take-up in adoption in 2020/21, which is the Non-Fungible Token (NFT). NFT’s are, in most cases, digital artworks in the form of an image, video or other digital assets that are unique (BBC News, 2021). Some early projects such as Crytopunks and Cryptokitties have exploded in popularity. One of the most expensive NFT ever sold was by the artist Beeple, whose piece titled ‘The first 5000 days’ sold for US$69 million (Finder 2021).

For cryptocurrencies, the next big movement will be institutional adoption and government regulation to protect investors and deter its use in criminal activities (Builtin, n.d). There are also nation-states looking at ways to bring the technology into their economies as a legitimate form of currency, El Salvador being the first country to do so (ABC, 2021). Blockchain will be used with other emerging technologies such as the Internet of Things (IoT), machine learning and artificial intelligence, autonomous vehicles and agricultural technology to name, but a few (Daley, n.d.).

Figure 1: The benefits of blockchain technology. (Euromoney Learning, 2020)

Blockchain has been mainly associated with cryptocurrencies, and it has seen the most development in that space, yet there are a range of sectors globally that could benefit from their potential to generate economic growth, as identified in a report from PwC. The key areas focus on healthcare, government and public services, manufacturing, finance, logistics and retail (PwC, 2020).

Healthcare could see a secure database of medical records that could safely and efficiently be shared with authorised medical staff and patients alike, without the risks of attack that a central database would have (Spratz, 2018). Medical supplies and vaccines could be accurately tracked, monitoring the origin of ingredients, production and shipping, a tool in the fight against counterfeit drug manufacturing (Peerbits, n.d.).

Logistics and retail could see increased benefits through the use of blockchain technology with tracking and tracing product provenance in situations where a product may be faulty. A retailer/supplier/manufacturer would be able to use the blockchain records to target the point of failure by highlighting the batch and shipment numbers. Time-sensitive products like perishable food items and some medicines could be tracked through IoT devices attached to lot shipments. That could signal points of unsafe temperature fluctuations, for example, pinpointing areas for attention in an efficient manner (Gaur & Gaiha, 2020).

With blockchain being an emerging technology, a lot still needs to be done. This is especially clear in the cryptocurrency space, which has seen the most growth but has also highlighted some of the issues for this space, with the lack of regulation, leaving it open to manipulation, and some issues with money laundering and criminal activities affecting the trustworthiness of cryptocurrencies (Gaur & Gaiha, 2021). Improvements with trust will bring institutional adoption that could severely disrupt the traditional financial sector as cryptocurrencies provide a new way to do finance, with conventional banks being made obsolete (Haar, 2021). Those who were previously unable to access banking services can now do so using a mobile phone, which could be the ticket that leads them out of poverty (Tarud, 2021).

Figure 2: Simple explanation of a transaction on the blockchain. (Hutt, 2016)

The future for blockchain and cryptocurrencies and its effects are somewhat unknown and difficult to predict. In many cases, it may not have an obvious impact on family, friends and ourselves directly in day-to-day activities. We anticipate that the transition will be somewhat seamless for regular citizens, and the disruption would be minimised. I see that the most obvious benefits of a blockchain and cryptocurrencies will come in terms of new payment, investing and lending methods on offer to customers. Identity proof and transfer methods will improve as one identity record can be shared across multiple services, especially in health care and government services. Electronic voting may become viable as authentication can be linked directly to your identity record. Customers could shop and have information about the origin of the products or services they may purchase that consider environmental and human rights factors.

The speed at which transactions can occur will increase significantly as intercountry transfers happen within seconds, with minimal fees incurred, passing savings back to the customer. The sale of large assets, like real estate, could be done on the spot without the need for a third party to mediate; it may just require an application where details are entered to generate a smart contract that would be effective from an agreed date and with certain conditions being met before an instant, verified, low fee and secure transaction taking place.

References

- ABC News, 2021, El Salvador becomes first country in the world to accept cryptocurrency bitcoin as legal tender, ABC News, viewed 9 October 2021, < https://www.abc.net.au/news/2021-09-07/el-salvador-adopts-bitcoin-crypocurrency-as-legal-tender/100441472>.

- Builtin, n.d., Blockchain Technology Defined, viewed 25 September 2021, < https://builtin.com/blockchain>.

- BBC News 2021, What are NFT’s and why are some worth millions?, BBC News, viewed 27 September 2021, < https://www.bbc.com/news/technology-56371912>.

- Conway, L 2021, Blockchain Explained, Investopedia, viewed 25 September 2021, < https://www.investopedia.com/terms/b/blockchain.asp>.

- Daley, S 2021, 35 Blockchain Applications and Real-World Use cases disrupting the status Quo, Builtin, viewed 26 September 2021, < https://builtin.com/blockchain/blockchain-applications>.

- Euromoney Learning, 2020, What is Blockchain?, Euromoney, viewed 10 October 2021, < https://www.euromoney.com/learning/blockchain-explained/what-is-blockchain>.

- Finder 2021, Top 15 Most Expensive NFT’s, Finder, viewed 27 September 2021, < https://www.finder.com.au/most-expensive-nfts>.

- Frankenfield, J 2021, Cryptocurrency, Investopedia, viewed 26 September 2021, < https://www.investopedia.com/terms/c/cryptocurrency.asp>.

- Gaur, V & Gaiha, A 2020, Building a Transparent Supply Chain, Harvard Business Review, viewed 27 September 2021, < https://hbr.org/2020/05/building-a-transparent-supply-chain>.

- Haar, R 2021, The future of cryptocurrency, Time, viewed 27 September 2021, < https://time.com/nextadvisor/investing/cryptocurrency/future-of-cryptocurrency/>.

- Hutt, R 2016, All you need to know about blockchain, explained simply, World Economic Forum, viewed 10 October 2021, < https://www.weforum.org/agenda/2016/06/blockchain-explained-simply/>.

- IBM, n.d., What is Blockchain?, IBM, viewed 27 September 2021, < https://www.ibm.com/au-en/topics/what-is-blockchain>.

- Ketchell, M 2021, What is Decentralised Finance?, The Conversation, viewed 27 September 2021, < https://theconversation.com/what-is-decentralized-finance-an-expert-on-bitcoins-and-blockchains-explains-the-risks-and-rewards-of-defi-161479> .

- Murray, M 2018, A Reuters Visual Guide: Blockchain Explained, Reuters, viewed 27 September 2021, < http://graphics.reuters.com/TECHNOLOGY-BLOCKCHAIN/010070P11GN/index.html>.

- PwC, 2020, Blockchain technologies could boost the global economy US$1.76 trillion by 2030 through raising levels of tracking, tracing and trust, PwC Global, viewed 27 September 2021, < https://www.pwc.com/gx/en/news-room/press-releases/2020/blockchain-boost-global-economy-track-trace-trust.html> .

- Peerbits, n.d., Impact of Blockchain technology on healthcare sector, Peerbits, viewed 27 September 2021, < https://www.peerbits.com/blog/blockchain-technology-on-healthcare-industry.html>.

- Shumba, C 2021, Cardano says it's added smart contracts to its network after the alonzo upgrade - while its ada token runs into profit-taking, Forbes, viewed 9 October 2021, < https://markets.businessinsider.com/news/currencies/cardano-ada-alonzo-upgrade-defi-smart-contracts-charles-hoskinson-2021-9> .

- Spratz, K 2018, Eight Ways Blockchain Will, Impact The World Beyond Cryptocurrency, Forbes, viewed 27 September 2021, < https://www.forbes.com/sites/theyec/2018/03/09/eight-ways-blockchain-will-impact-the-world-beyond-cryptocurrency/?sh=4a84d0c81883> .

- Tarud, J 2021, Is Traditional Banking Under Threat from Cryptocurrency, Koombea, viewed 27 September 2021, < https://www.koombea.com/blog/cryptocurrency/>.

- Yaga, D, Mell, P, Roby, N & Scarfone, K 2018, Blockchain Technology Overview, National Institute of Standards and Technology: U.S. Department of Commerce.